The Stock Market is the device to transfer wealth from the IMPATIENT to the PATIENT.

After swinging in a range for almost one and half years, markets breached their previous peaks and are scaling new one now. Markets have risen by almost over 14% in last three months. Major reason for this sudden rise is the return of FIIs to the Indian stock markets following the fact that India is the fastest growing economy and growing over 6% despite covid, global economic slowdown and geo-political tensions.

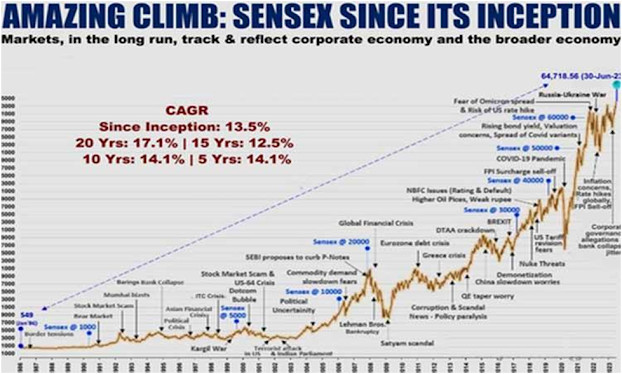

We invest for long term and everyone knows in the long run markets will go up irrespective of intermittent shocks like scams, dot-com bubble, Lehman crisis, covid or banking troubles in USA etc. Following picture depict the journey of Sensex over 40 years since its inception.

Source; www.thenwsmen.co.in

The unfortunate part is we are more concerned about the short term movements of the markets. Every time there is sudden rise or fall in them market we are gripped more by fear and less by greed. All of us try to follow the dictum, well popularized by social and media influencers – Invest at low and exit at high. But who tells us – yes this is the high or this is the low. In the above chart can we find the highest point?

A recent study showed that if you were investing every year at the highest point for last 30 years in Sensex, still you would have earned over 11% CAGR. Should you have been lucky enough to invest at the lowest levels of the years for the same period, you could have earned returns over 15% CAGR. And a decent portfolio of SIPs into mutual fund schemes could have earned you 17-18% CAGR.

Imminent concerns – Monsoon that feared to be weak this year had been good so far. Inflation is under control and for this reason RBI hasn’t raised its policy rates for last two meetings. There seems no economic concern in front of Indian economy as of now except for global recession that we believe, will have much lesser impact on India as we have resilience to many financial crisis and are moving steadily towards achieving self reliant economy.

Regarding geo-political risks - Revolt in Russia that could have worsened the Russia-Ukraine war was managed within 24 hours. Will China attack Taiwan or India – my answer to this is NO. It has seen Russia’s fate of such adventurism. Will Pakistan disintegrate – even if that happens it won’t make much economic impact in short to medium term for India.

Elections to Indian Parliament – Whether the BJP led or NDA or Congress led UPA forms the government, there won’t be any impact on the economic policies and thus markets should remain buoyant. If the communists have a major say in the formation of the central government then it can cause concerns – though it has almost zero probability as of now. And we also know such governments are very short-lived.

There are good numbers of examples where the analysts felt that markets have reached their peaks and should correct from those levels. Instead markets rose more sharply from there and corrected after gaining another 20-25% or even more from there before correcting or stagnating. The only way to follow peaks and troughs of the market is asset allocation and portfolio rebalancing.

What should you do with Sensex@64,718 talk to your InvestmentMitra and your Mitra will guide you to what is best in your situation or whatsapp your query to 995847700 or write to contact@investmentmitra.com.

Thank you.

Happy Investing!

Team InvestmentMitra

Comments

Post a Comment